In the ever-changing landscape of Florida’s employment regulations, businesses must stay ahead of the curve. Starting…

Navigating Florida’s New Employee Verification Regulations: A Comprehensive Guide

October 25th, 2023

What is the CalSavers program, and what does it mean for companies in California?

July 7th, 2022

The CalSavers program started in July of 2019 as a way for companies to help their employees save money for retirement. While…

How to know if you are ready for managed payroll services?

December 10th, 2021

Recently a small business owner shared their frustrations with processing payroll. Preparing checks, calculating taxes,…

Missed out on the PPP loan? Learn about the 3 NEW credits available to all employers

June 26th, 2020

Due to the significant impact of Covid-19 on businesses, the government has established several important payroll related…

Payroll Information for Paycheck Protection Program (PPP) Loan

April 20th, 2020

In order to apply for the Paycheck Protection Program (PPP), an SBA loan that helps businesses keep their workforce employed…

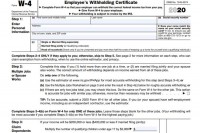

Learn about the new W-4 form. Plus our free calculators are here to help!

January 23rd, 2020

How Taxpayers Estimated Withholdings Previously

When a company hires an employee, the company is required to withhold…

What to do if you receive a letter from the SSA or the IRS

August 24th, 2018

If you receive a letter from the SSA or the IRS referring to discrepancies in Income tax, Social Security, and Medicare tax

…

What is “Name Control”? Why was my form 941 e-file rejected?

November 2nd, 2017

One of the most common reason for IRS rejecting a form 941 e-file is the “Name Control” is wrong. The IRS error & rejection…

How To Manage Small Business Payroll – Part I

July 24th, 2017

Paychecks, payroll tax calculations, tax deposits, and reporting for small businesses

The latest business census from…

What is the difference between employee payday/check date, pay period, and pay cycle?

March 15th, 2017

- Payday/PayCheck Date is the date printed on the paycheck.

- Pay Cycle is how often the company pays the employees.

- Pay Period